How to choose life insurance.

Life insurance is one of those topics that many of us prefer not to dwell on too much. However, ensuring that you have the right policy in place is a crucial aspect of financial planning. By overlooking life insurance, you leave your family at risk of becoming vulnerable to financial hardship if you were to pass away unexpectedly. Whether it’s replacing lost income, covering outstanding debts or funding future expenses like education or mortgage payments, the right life insurance policy can provide peace of mind and financial security for your loved ones during a difficult time.

Given the multitude of options available, navigating the complexities of life insurance can be daunting. Thankfully, specialists like The Insurance Surgery are dedicated to simplifying the process, offering expert guidance to help you make informed decisions tailored to your unique needs and circumstances.

Which life insurance is best?

When it comes to life insurance policies, there’s no one-size-fits-all solution. Each policy will have its own set of variables that can significantly impact cover and financial security. Several key factors can vary significantly from one life insurance policy to another. These include:

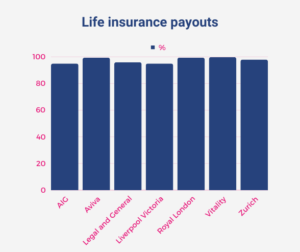

Provider: The insurance provider you choose can have a significant impact on the quality of your cover and the reliability of your policy. It’s essential to select a reputable and financially stable insurance company with a track record of timely claims processing and excellent customer service. Your mortgage broker or financial adviser may have insights into reputable providers and may offer recommendations based on their expertise and industry knowledge. Additionally, you can speak with a protection adviser from The Insurance Surgery to gain free and impartial advice on the best provider for your needs.

When selecting a life insurance provider, payout rates are a crucial factor to consider as they directly impact the likelihood of your beneficiaries receiving the intended financial support. According to data from the Association of British Insurers (ABI), the overall payout rate for new life insurance claims in 2022 stood impressively high at 96.9%, slightly down from the previous year’s 97%. This means that out of the 53,105 new claims made, the vast majority were successfully paid out, providing essential financial assistance to policyholders’ families during challenging times.

Duration: Life insurance policies can vary in duration, offering cover for specific periods known as ‘term’ policies or for your entire lifetime with whole-of-life policies. Term policies typically provide cover for fixed terms, such as 10, 20, or 30 years, while whole-of-life policies offer lifelong protection. Consider your financial goals and the duration of your financial obligations when selecting the appropriate policy duration.

Level of Cover: The amount of cover provided by a life insurance policy should align with your financial needs and obligations. Factors such as income replacement, outstanding debts, future expenses and the financial needs of your dependents should all be considered when determining the level of cover required to adequately protect your loved ones.

What’s Covered/Excluded: It’s essential to carefully review the policy documents to understand what is covered and excluded from your life insurance policy. Common exclusions may include pre-existing medical conditions, high-risk activities or death by suicide within a certain period after policy inception. Understanding the scope of cover and any limitations or exclusions is crucial to avoiding surprises during the claims process.

With assistance, navigating the complexities of life insurance can become a seamless and straightforward experience, ensuring that you have the cover you need to protect what matters most.

What is the difference between life insurance and life assurance?

When browsing for life insurance, you may notice that some companies use the terms “life insurance” and “life assurance” when describing different policies. While these terms are often used interchangeably, they can refer to different types of cover:

Life Insurance: Where the terms insurance and assurance are used, life insurance typically refers to term life insurance, which provides cover for a specified period, such as 20, 30 or 40 years. If the insured individual passes away during the policy term, a death benefit is paid out to the beneficiaries. Term life insurance is often more affordable and offers a straightforward way to protect against financial risks during specific life stages.

Life Assurance: This term is commonly associated with whole-of-life insurance, which provides cover for the insured’s entire lifetime. Whole-of-life policies offer lifelong protection, as the name suggests. Upon the insured individual’s death, a lump sum is paid out to the beneficiaries. These policies are usually more expensive, but you can ensure that the policy term never runs out – offering more financial stability in the long run.

Seeking assistance from reputable specialists like The Insurance Surgery can provide insight and support throughout the decision-making process. Whether you’re looking for recommendations on reputable providers or need guidance on understanding policy terms and conditions, our team is here to help.

For more information, speak to The Insurance Surgery today: 0800 083 2829.