Many people delay protection until they buy a home or have children. Unfortunately, by then, premiums are higher, and health issues can limit your options. Taking cover early allows you to lock in low costs and protect your future on your terms.

What Types of Protection Should Under-40s Consider?

Life Insurance

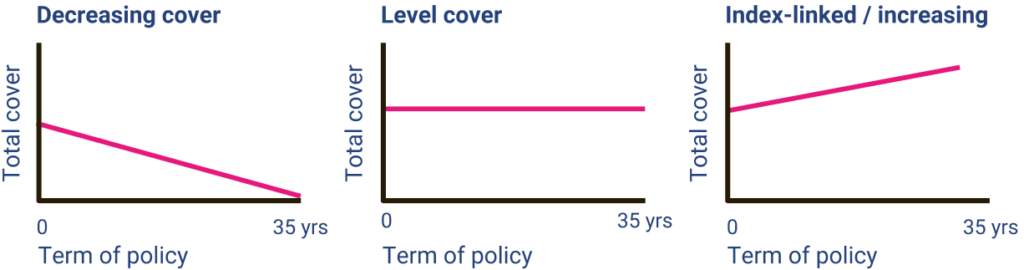

Life insurance pays a lump sum if you die during the policy term. It is commonly used to:

- Protect a mortgage or rent commitments

- Provide financial security for a partner or family

- Cover everyday living costs and debts

Income Protection

Income protection replaces a portion of your income if you’re unable to work due to illness or injury. It can:

- Pay up to 60–70% of your salary

- Cover long-term illness or injury

- Continue until you return to work or retire

This is often considered the most important protection policy, especially for people early in their careers.

Critical Illness Cover

Critical illness cover pays a tax-free lump sum if you’re diagnosed with a serious condition such as cancer, heart attack, or stroke. The money can be used for:

- Mortgage or rent payments

- Medical treatment or rehabilitation

- Time off work to recover

Why Is Protection Cheaper When You’re Under 40?

Lower Risk Means Lower Premiums

Insurers assess risk based on age, health, and lifestyle. Younger applicants are statistically less likely to claim, which results in:

- Lower monthly premiums

- Better policy terms

- Fewer exclusions

Once a policy is in place, premiums are usually fixed for the full term.

Fewer Health Restrictions

As you get older, it becomes more likely that insurers will uncover:

- High blood pressure

- Mental health history

- Back, joint, or musculoskeletal issues

These can lead to higher premiums, exclusions, or declined applications. Applying earlier gives you access to broader cover while you’re at your healthiest.

The following figures are illustrative UK averages for a healthy non-smoker. Actual costs will vary depending on personal circumstances.

Life Insurance – £250,000 Cover Over 30 Years

Age When Policy Starts | Approx. Monthly Cost |

|---|

25 | £10–£12 |

30 | £13–£16 |

35 | £18–£22 |

40 | £30–£35 |

Critical Illness Cover – £100,000 Cover Over 30 Years

Age When Policy Starts | Approx. Monthly Cost |

|---|

25 | £30–£35 |

30 | £40–£45 |

35 | £55–£65 |

40 | £85–£100 |

Income Protection – £2,000 Monthly Benefit

Age When Policy Starts | Approx. Monthly Cost |

|---|

25 | £25–£30 |

30 | £35–£40 |

35 | £45–£55 |

40 | £65–£80 |

Starting younger can reduce premiums by up to 50% and save tens of thousands of pounds over the policy term.

You might be looking specifically at over-40s life insurance, but we can discuss your options and determine whether you need to add other insurances, such as critical illness cover or income protection. Sometimes, you could significantly improve your family’s financial security for just a few extra pounds.

How Will Life Insurance Benefit You?

Life insurance can help your family cover various expenses such as mortgage payments, outstanding debts, education costs, funeral expenses, and everyday living expenses.

The decision to purchase a policy should be based on your individual needs, financial situation, and long-term goals. Consulting with an adviser can help determine whether life insurance is right for you.