Can you have more than one life insurance policy?

When you take out a mortgage or other significant financial arrangements are made, financial advisers may refer you to an insurance broker to consider life insurance. If this is the case, but you already have a policy in place, you might wonder whether it’s possible to amend or add to your life insurance cover to better serve your changing circumstances.

Can you have multiple life insurance policies?

Yes, you can indeed have multiple life insurance policies, as long as you provide honest and thorough information when applying and the policies are approved each time. Some of our customers have come to us believing that it’s illegal to have more than one policy. Fortunately, this simply isn’t true. Multiple life insurance policies aren’t just legal – in some cases, they’re the best option.

Why opt for multiple life insurance policies?

Adding multiple life insurance policies may seem counterintuitive at first glance. However, there are several reasons why individuals may choose this approach. For example, if your situation has changed since you took out your policy, you may want to adjust it to take into account getting married, having children, obtaining a larger mortgage or taking on further financial responsibilities.

Individuals may also want to increase the level, condition or duration of their life insurance cover. Multiple life insurance cover can help achieve these goals by providing additional protection. By having multiple policies from different insurers, individuals can diversify their cover and lessen the risk of being underinsured. Each policy may also offer unique features, benefits, and payout structures, providing a more comprehensive safety net for beneficiaries.

To access different types of life insurance policy:

If you originally took out one type of life insurance policy and now a different one would suit you, that’s a good reason to add or amend an insurance policy. The different types are:

- Level term: This type of policy pays out a fixed lump sum if the policyholder passes away within the agreed-upon term.

- Decreasing term: With this policy, the payout amount decreases over time within a fixed period. It’s often utilised to cover assets such as mortgages or other debts and is typically more cost-effective.

- Whole of life insurance: Also referred to as life assurance, this policy has no end date; it only terminates upon the policyholder’s death and ensures that your family receives a payout.

- Joint life insurance: This policy provides cover for two individuals, with the payout occurring upon the first death. In such cases, the sum is paid to the surviving policyholder.

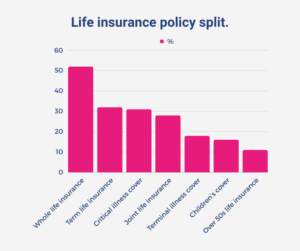

Based on a survey conducted by Forbes Advisor, individuals with a life insurance policy will have one of the following:

To cover a variety of financial needs:

If your financial needs vary, you might consider having multiple protection policies instead of multiple life insurance policies. Combining life insurance with critical illness cover is a popular choice, for example, as it offers distinct advantages. This combination provides financial support in the event of a serious illness diagnosis while also providing cover to family members in the case of death during the policy term.

Another example could be that one policy may focus on income protection, providing a monthly wage if you become sick or injured, while a life insurance policy can cover expenses like mortgage payments or funeral costs.

To secure a larger cover amount:

Some individuals may require a larger cover amount than what a single insurance provider can offer. By obtaining multiple policies from different insurers, the amount can then meet any specific financial needs and obligations. This approach ensures that beneficiaries are adequately protected in the event of the policyholder’s death and provides peace of mind knowing that sufficient funds will be available to cover expenses and financially support loved ones.

To achieve greater flexibility in policy management:

Having multiple policies allows for greater flexibility in policy management. Individuals can adjust cover levels, beneficiaries and other features independently for each policy. Providing more control over their life insurance plan.

To bolster existing workplace benefits:

In some cases, individuals may have cover through their employer or other group life insurance policies. Increasing this cover with additional individual policies can provide added financial protection. This can be especially desirable if the employer-provided cover is limited or if you’re considering leaving a job that pays out life insurance. If you were to do so, your employer-provided cover would stop as soon as you leave the job.

To meet estate planning and legacy goals:

Multiple life insurance policies can be used strategically. For example, individuals may designate specific policies to cover estate taxes, provide for charitable donations or create an inheritance for heirs.

Opting for multiple life insurance policies offers flexibility, customisation, and enhanced protection for individuals and their loved ones. By carefully assessing financial needs and goals, individuals can determine the most suitable combination of policies to meet their unique circumstances and objectives.

Can you cancel life insurance?

It is possible to adjust life insurance cover as needed. Typically, this process involves notifying the life insurance provider and requesting either a reduction or cancellation of the policy. Providers often offer options to decrease cover levels or modify other policy features to make premiums more affordable. If a customer chooses to cancel the policy entirely, they can do so without encountering any issues.

What happens if you cancel your life insurance policy?

It’s important to understand that once a policy is cancelled, the originally approved premium will change over time. Generally, premiums increase every six months for individuals who haven’t locked in their policy terms.

For instance, if someone seeks life insurance at the age of 26 but doesn’t secure a policy until they’re 28. The same policy will likely increase in cost over the next two years. Therefore, it’s advisable to obtain life insurance at an earlier age, as premiums tend to rise with age due to the heightened risk of health issues. This means that if you cancel your life insurance now, then decide to reapply in the future. You can expect your premiums to be larger.

Instead of cancelling, it may be best to speak with a specialist broker to review your life insurance policy, to ensure you are getting the best deal.

Will I get my money back if I cancel my life insurance policy?

Once a policy is cancelled, the customer will no longer be required to pay premiums from that time onwards. However, it’s essential to note that customers will not be eligible for a refund of previously paid premiums unless they cancel within the cooling off or grace period. This period is typically 14 days but can vary depending on the insurer and policy terms.

At The Insurance Surgery, our specialist protection advisers are dedicated to guiding customers through all aspects of their life insurance policies. We ensure that customers fully understand the terms and conditions of their policies, including any cooling-off periods.

For more information, speak to The Insurance Surgery today: 0800 083 2829.